Total Retirement Sum can be a crucial idea in retirement planning, particularly within just specified national pension strategies. It signifies the sum of money that individuals will need to possess saved by their retirement age to ensure a gradual stream of money for the duration of their retirement many years. Here is an intensive overview:

What is the Whole Retirement Sum?

The Full Retirement Sum is basically a concentrate on cost savings amount of money set by pension strategies or governments that can help retirees preserve a standard standard of residing once they prevent Functioning. It can be designed to go over necessary expenses like housing, healthcare, and each day dwelling prices.

Important Elements

Age: The FRS generally applies any time you get to the Formal retirement age, which can vary according to your region or precise pension plan.

Price savings Accumulation: Throughout your Operating existence, you contribute a portion of your earnings into a selected retirement account.

Payout Composition: On achieving retirement age, these discounts are transformed into standard payouts that give fiscal assist through your retired daily life.

How can it Perform?

Contributions:

In the course of employment years, both workforce and businesses make contributions toward the individual's retirement fund.

These contributions develop over time as a result of investments managed because of the pension scheme.

Accumulation Phase:

The intention is to accumulate sufficient resources With this account to ensure it reaches or exceeds the FRS by the time you retire.

Payout Section:

As soon as you hit retirement age and meet up with other eligibility criteria (like residency prerequisites), you begin receiving regular payouts from this accrued sum.

These payouts are structured to past through your expected life time.

Why Is It Critical?

Monetary Protection: Ensures that retirees have enough income for primary requirements devoid of solely counting on other resources like loved ones aid or social welfare plans.

Inflation Defense: Numerous strategies regulate the FRS periodically to account for inflation and modifications in Charge-of-dwelling specifications.

Relief: Understanding there’s a structured prepare for write-up-retirement earnings alleviates pressure about upcoming monetary balance.

Realistic Case in point

Envision you are 30 several years outdated and setting up your initial work using an yearly wage of $fifty,000:

Each and every month, as an example ten% ($five hundred) goes into your focused retirement fund—five% from you ($250) and five% matched by your employer ($250).

Around one year, that's $six,000 contributed click here to your future FRS.

Assuming a mean once-a-year return on investment of five%, these price savings will grow significantly over time due to compound interest.

By continuously contributing around various a long time although benefiting from compounded development prices and periodic changes for inflation produced by pension authorities, you may ideally reach or surpass the demanded Whole Retirement Sum upon retiring at around sixty five several years previous.

In summary:

The entire Retirement Sum makes certain extended-term money safety throughout non-Doing the job several years.

Normal contributions coupled with strategic investments aid achieve this focus on sum.

Knowing how it really works empowers folks to raised put together economically for their golden decades.

By concentrating on dependable conserving patterns early in one's job and knowing how these cash will probably be used later on can cause safer and fulfilling retirements!

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Tatyana Ali Then & Now!

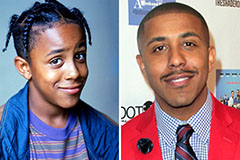

Tatyana Ali Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!